Article Advice

When taking aside a house security credit line (HELOC), this new HELOC mark months can be your possibility to spend the currency you’ve been accepted to borrow against your home guarantee. Like a credit card, you just spend what you would like around a-flat restriction to make minimal costs up to your mark several months finishes.

It is vital to recall, in the event, which you are unable to accessibility the financing range any more just like the draw several months is over, and you might need start making much larger money. Here’s what you must know just before your own HELOC draw period comes to an end.

What exactly is an excellent HELOC draw months?

An excellent HELOC enjoys several phases: brand new mark several months in addition to payment months. A person is to own spending the money and one is actually for using it right back. Everything you in the course of time want to know till the draw period stops is how you want to settle the credit range. Based on your personal fees means, there might be strategies take till the draw months ends.

What if you got away a HELOC to fund an effective home improvement project, particularly doing their cellar; the newest draw period is the window of your energy when you may be purchasing systems, color and other provides. In most cases, their bank offers credit cards otherwise special monitors you can use to expend the money. They are going to in addition to put your borrowing limit, or even the limitation matter you might borrow, based on how much house equity you have got.

Their mark months is a-flat long time, have a tendency to ten years. In those days you are going to need to build minimum attention repayments, in many cases you will not have to pay along the prominent balance. That it normally mode apparently reasonable costs that are different for how far you have lent, identical to that have a credit card.

At the conclusion of brand new draw several months, you will be can my parents pay off my student loans able to replenish your personal line of credit and you can restart the clock. Otherwise, it is possible to enter the payment months.

How does HELOC fees performs?

Once the fees period attacks, you will be no longer able to purchase more of one’s currency and you are clearly necessary to begin paying back that which you you’ve lent, with interest. Given that the times of great interest-only costs try more than, predict their monthly obligations in order to jump-up rather – especially if you don’t pay down the principal harmony anyway through your draw several months.

The repayment several months will generally feel a-flat while, generally ten to 20. Really HELOCs possess adjustable rates, which means that your monthly payment will get change over the category of the fees period. This can be distinctive from a fundamental mortgage otherwise domestic guarantee loan, all of you instantly start repaying which have a predetermined interest, definition your own monthly obligations cannot alter.

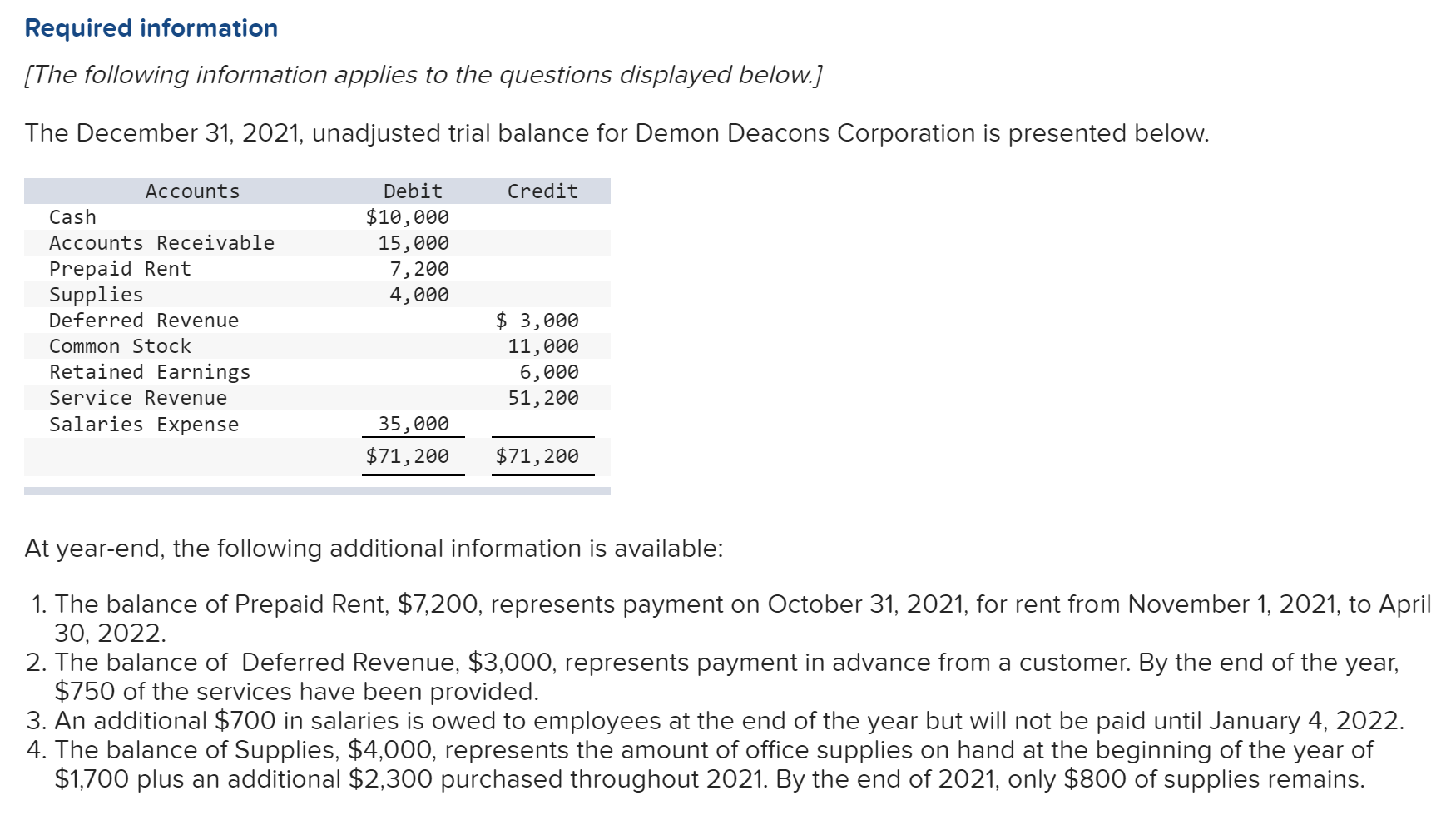

HELOC cost example

To return to the before analogy, imagine if that your particular cellar renovation is becoming long complete. As a whole you invested $twenty-five,000 to the information, and you also picked a fixed-speed HELOC with good 6% interest. You’ve due to the fact organized half of-a-dozen Super Pan events on the place, but during that time your don’t pay over the minimum (interest-only) costs. This is what your repayments manage seem like in both brand new draw and you will payment attacks:

HELOC benefits alternatives for before the draw period concludes

When you’re taking right out a great HELOC, possible often have many different alternatives for investing it straight back. Here are some which need you to take action just before new mark months ends up.

1. Make lowest costs

It is Ok to really make the minimum money within the mark several months if you are keeping tabs on in the event the draw several months ends and you will exacltly what the repayments looks including once it can. It is far from uncommon for monthly premiums so you can more than twice once brand new repayment period hits.