The first mortgage lien is pulled that have an enthusiastic 80% loan-to-worth (LTV) ratio, for example it is 80% of your home’s costs; next mortgage lien features a 10% LTV proportion, and the borrower renders a great 10% advance payment.

Key Takeaways

- A keen 80-10-10 financial are prepared having one or two mortgage loans: the initial getting a fixed-speed financing from the 80% of your home’s rates; the following becoming ten% since the a home collateral financing; additionally the leftover 10% while the a finances deposit.

- Such mortgage plan reduces the advance payment away from good family without having to pay individual mortgage insurance coverage (PMI), enabling consumers get a property more easily for the up-front will cost you.

- not, consumers tend to deal with relatively huge monthly home loan repayments and could select large payments owed with the varying loan when the rates improve.

Skills an enthusiastic 80-10-ten Mortgage

???????When a potential resident expenditures a house that have lower than new fundamental 20% down-payment, he is required to spend individual home loan insurance policies (PMI). PMI are insurance policies you to definitely handles the lending company financing the cash up against the likelihood of new borrower defaulting with the a loan. A keen 80-10-ten financial is oftentimes utilized by individuals to end expenses PMI, which would generate a beneficial homeowner’s monthly payment high.

Generally, 80-10-ten mortgages were popular oftentimes when home prices is speeding up. As the homes become quicker reasonable, and then make an effective 20% downpayment of money could well be hard for just one. Piggyback mortgages ensure it is customers so you can acquire more funds than their down fee you are going to recommend.

The original financial away from an enthusiastic 80-10-10 home loan is normally always a predetermined-rates home loan. The second financial can be a varying-rate home loan, eg a home security financing or domestic equity line of borrowing from the bank (HELOC).

Benefits of a keen 80-10-ten Home loan

The next home loan features for example a credit card, but with a lower interest rate once the collateral in the family have a tendency to straight back they. $20000 loan bad credit As a result, it merely runs into attract if you are using it. Thus you can pay back our home guarantee mortgage or HELOC completely or perhaps in part and dump desire payments on that cash. Moreover, immediately after paid, the new HELOC stays. This credit line can also be act as a crisis pond to many other costs, such as for example domestic home improvements if not education.

A keen 80-10-10 financing is a great choice for people who find themselves trying to shop for a property but i have not even ended up selling the current home. Because condition, they would utilize the HELOC to pay for a portion of the deposit to your new home. They would pay-off the latest HELOC if old home carries.

HELOC rates of interest try greater than people to have conventional mortgage loans, that can somewhat offset the coupons gathered by having an 80% financial. If you plan to pay off brand new HELOC within this a number of ages, this isn’t always a problem.

When home values try rising, your own guarantee will increase with your home’s worth. But in a housing market downturn, you are leftover dangerously under water which have a property which is really worth lower than you owe.

Example of a keen 80-10-ten Mortgage

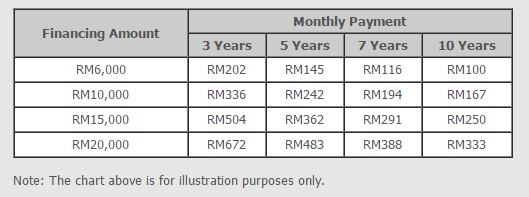

The brand new Doe family relations really wants to pick a property to have $3 hundred,000, and they’ve got a deposit regarding $31,one hundred thousand, that’s 10% of the complete house’s worth. That have a normal ninety% home loan, they are going to need to pay PMI in addition month-to-month mortgage payments. Together with, an effective ninety% financial will generally hold a higher interest.

As an alternative, the fresh new Doe nearest and dearest can take away an enthusiastic 80% financial for $240,one hundred thousand, perhaps during the a diminished interest rate, and get away from the need for PMI. At the same time, they will take out an additional ten% home loan regarding $30,000. It most likely will be good HELOC. The fresh down-payment remain ten%, nevertheless family have a tendency to end PMI costs, get a better interest, which means keeps lower monthly payments.