- Expansion off device choices to the the brand new first-lien HELOC

- Goals a giant erican people as opposed to a mortgage)

- Flexible conditions and around three-12 months draw months and you may prospective ten-year interest-simply percentage months

- Phased national rollout package, currently available in the seven states

- Nothing.

Skills

from American residents mortgage-free, the product contact a substantial unexploited chance. New flexible terms and conditions, including good 3-12 months mark several months and prospective ten-seasons notice-merely payments, allow it to be an appealing option for home owners seeking to exchangeability. Which expansion you will definitely broaden LDI’s funds channels and you can possibly boost its market share home equity financing room. But not, this new phased rollout approach suggests mindful optimism, making it possible for the business to evaluate and you may improve the product ahead of a good full national launch. People is to screen the latest product’s use price and its particular affect LDI’s financials on the upcoming household.

This new timing from loanDepot’s equityFREEDOM First-Lien HELOC launch was strategically voice. Having property owners sitting on checklist levels of equity and you will up against rising costs, the new interest in including points is likely to improve. This new item’s independence suits some user means, from your home renovations in order to debt consolidation reduction, possibly increasing the appeal. The original rollout when you look at the eight claims, also significant places including California and you will Florida, enables a controlled expansion and market evaluation. This method may help LDI hone its offering centered on early use activities before organized national extension of the later 2024. The prosperity of the product you will definitely rather effect LDI’s competitive reputation throughout the evolving home equity sector.

Which product’s judge build you certainly will lay a good precedent for the very same products on the market

This new equityFREEDOM Very first-Lien HELOC brings up some court factors for both loanDepot and you will customers. Given that an initial-lien tool, it requires consideration over any further liens, probably impacting borrowers’ coming financing alternatives. The new mention of the potential taxation deductibility is actually prudently licensed, acknowledging the newest complexity out of tax effects. The latest different words across says focus on the necessity for mindful regulating conformity. LDI need to ensure clear revelation regarding terms and conditions, specifically regarding the attention-simply period and you will next amortization. Because the equipment develops across the nation, staying through to county-particular financing rules might possibly be very important.

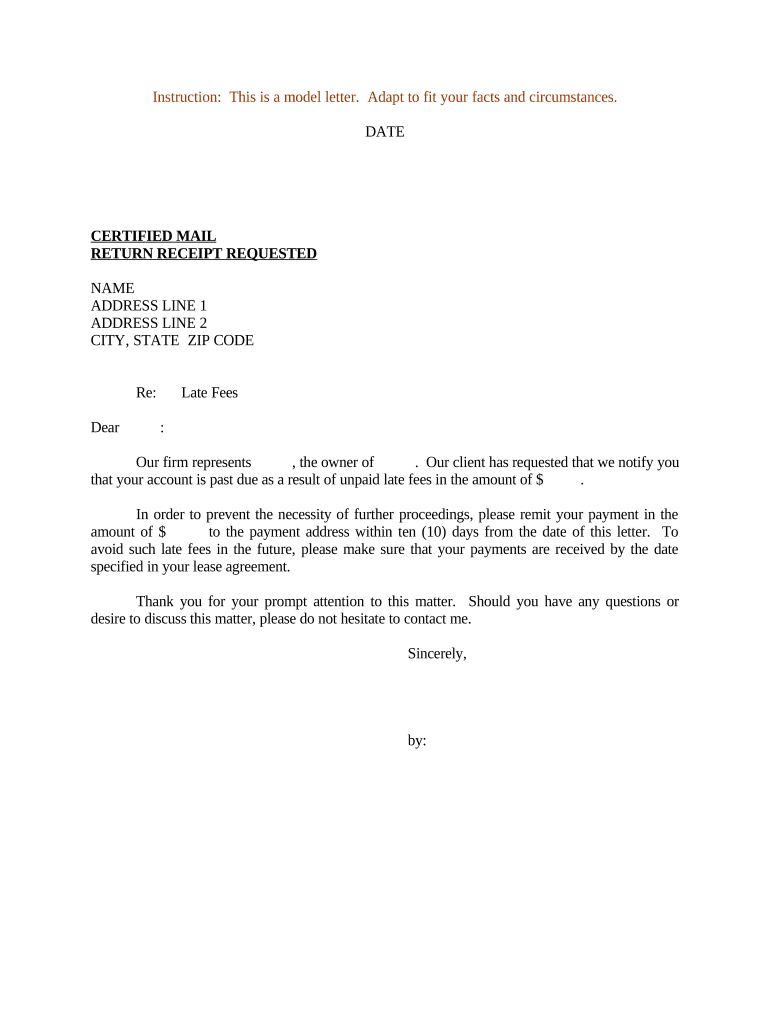

IRVINE, Calif. –(Business Cable)– loanDepot, Inc. (“LDI” or “Company”) (NYSE: LDI), a number one supplier of goods and you will services that energy the homeownership travels, has grown their equityFREEDOM tool suite to add a first-lien family security line of credit (HELOC). The fresh new HELOC lets the new

from American residents without a mortgage step 1 to help you acquire from their home’s security to own high expenditures particularly family home improvements or college tuition, or even consolidate large interest credit card debt. They contributes a new powerful monetary tool so you’re able to loanDepot’s collection of goods and properties one to secure the lifetime homeownership travels of their users.

“Residents was standing on unprecedented levels of equity immediately, such as people that not any longer carry a home loan,” said LDI Chairman Jeff Walsh. “But not, also in place of a home loan, of several feel the pinch out of rising expenses, including insurance rates and you can property taxation, and therefore set a lot more stress on the month-to-month spending plans. For this reason we now have additional the initial-lien substitute for the equity credit collection to help with all of our users from totality of its homeownership travels, not merely inside the longevity of the mortgage.”

The capability to tap into security was a primary advantage of homeownership as you possibly can lower the price of borrowing to possess high expenses – and you can, sometimes, the interest tends to be tax-deductible dos . A first-lien HELOC is actually for consumers who don’t has a preexisting financial on their house 3 .

The equityFREEDOM First-Lien HELOC lets instance individuals to access the collateral within their house that have versatile words which include a about three-seasons mark cash advance online Wadley AL several months, and you may, for the majority states, a 10-season desire-just commission months followed by a great 20-seasons amortizing cost identity cuatro .