Compliant mortgage restrictions flower to help you $647,two hundred to have unmarried-unit house inside 2022, symbolizing an 18% increase-an usually highest jump in the year-over-season loan limits. Some tips about what you must know about what you to definitely raise you’ll indicate for your requirements-and you may a strong solution available should you decide fail to be considered.

Exactly what are the compliant financing constraints to own 2022?

Extent you could potentially obtain with a compliant loan, known as a regular mortgage, try modified yearly from the Government Houses Money Service (FHFA). Across all You within the 2022, this new borrowing limit to have one-tool house is to $647,two hundred, whilst in pricier components of the us, such as Their state, Alaska, the usa Virgin Isles, and you can Guam, the brand new credit limit try closer to $970,800. Men and women borrowing from the bank limitations rose since the 2021 if borrowing limit with the a single-tool home for the majority elements of the united states is $548,250 and also in people costlier countries are doing $822,375.

If you are this type of numbers depict the fresh credit limits getting solitary-tool home, it must be listed as you are able to and obtain extra money for two-device, three-product, and/otherwise five-product home.

Just how much is the compliant loan limits for each condition?

New Government Houses Fund Agency’s 2022 compliant mortgage constraints increase so you’re able to $647,2 hundred in most regions in the usa is a growth out of 18%-the most significant 12 months-over-12 months loans Frisco City loan limitation plunge into the previous memories. If you’re an effective transferee looking to move in, and you require some added to invest in power, so it development shall be extremely useful.

To track disparities in the housing affordability and you can imagine mortgage defaults region because of the region, the fresh new FHFA keeps identified highest-prices places that financing limitations provides increased to accommodate the brand new too much price of a residential property. In virtually any known higher-cost areas, new average household worthy of is over the newest baseline conforming mortgage restriction. The particular conforming loan limit is just as highest because 150% of your own baseline compliant loan limit, with respect to the median home worthy of in your neighborhood.

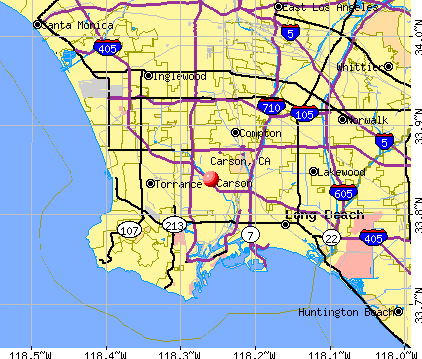

To possess evaluation, listed below are compliant financing constraints away from big centers into the four other claims. Inside Detroit, Michigan, the fresh conforming mortgage restrict consist at the $647,two hundred. The brand new conforming mortgage limitation increases to help you $694,600 from inside the Nashville, Tennessee. In San diego, California, meanwhile, the new compliant financing limit was $897,750 along with Jersey Area, Nj-new jersey, the borrowed funds maximum is just as much higher within $970,800.

Unique consideration is including supplied to the fresh new low-contiguous states and you can regions such as for example The state, Alaska, the united states Virgin Countries, and Guam, in which within the 2022 this new FHFA’s conforming mortgage restriction lies on $970,800.

Compliant money versus jumbo funds

An effective jumbo financing is generally recommended if you would like to acquire more FHFA possess welcome into the 2022. In other words, jumbo finance try mortgages for anyone demanding a much bigger mortgage than the fresh new FHFA constantly lets, and you may, than the compliant fund, ordinarily have large interest levels and stricter standards. And because jumbo finance bring increased risk to own loan providers, people generate qualifying more difficult to lessen the alternative one to a good borrower tend to standard toward one money.

When you’re lenders enjoys her requirements to have jumbo finance, you will likely you want a lower life expectancy debt-to-earnings ratio, a higher credit rating, and you may a larger down-payment than the conforming loans. A credit history with a minimum of 700 and you may a great 20% or even more advance payment will likely be required. A financial obligation-to-money ratio from anywhere between thirty-six-45% will in addition be needed. The better your debt-to-earnings proportion, the advance payment, and your credit history, a lot more likely youre to get approval having good jumbo financing.

If, in addition, your debt users as well as your credit score are too weak to own a conforming loan otherwise a beneficial jumbo loan, you can apply for an FHA home loan, that’s perfect for anyone who has a loans-to-money ratio lower than 43% and you will a credit rating as little as 580.

If you are a military representative, or if you are to purchase a house into the an outlying area, you could potentially choose a Va financial. You certainly do not need a downpayment having possibly of one’s home loan models. USDA mortgages usually have the same limitations just like the compliant funds and you will Virtual assistant mortgages do not have borrowing limits.

Transferees features a higher chance of buying property

As conforming money give reduce payment choice and you will aggressive financial interest levels, transferees get a high danger of buying a home. As the a great transferee, you are able to grow your search to your a high-stop housing industry with increased options, and less stress, as a consequence of a great deal more readily available purchasing power much less due during the closure desk.

Transferees exactly who otherwise might have been priced outside of the markets would be able to grow its browse requirements, potentially securing a unique possessions from the new-year.