Probably one of the most preferred types of borrowing from the bank now, aside from credit cards, is actually signature loans. Thanks to some extent to help you numerous fintech members, anyone can score signature loans inside several hours regarding anywhere. And best part? There’s absolutely no restrict to your prevent fool around with.

However, did you know that you can make use of personal debt to invest away from personal debt or even to be much more particular, you need to use signature loans to repay credit card debt ?

When you’re credit cards are preferred and you will incorporate numerous experts, it can be appealing so you’re able to overspend towards the points that do not you desire. These expenditures can spiral toward a large stack regarding personal debt one to is severely affect your finances. As well, the rate recharged for playing cards is even on the higher front. Although you ount due per month, this could add to the financial problems even more.

Such a posture, a personal loan can be away from assist. Check out of your benefits of having fun with unsecured loans so you can pay back credit card debt

Make the most of Down Rates of interest

One of the biggest advantages of handmade cards is the notice-totally free grace months (20 to help you two months). However, if you decide to spend next or if you shell out precisely the minimum amount due, upcoming a destination could well be recharged that is quite large.

In such cases, as opposed to not able to shell out each month, you can opt for an unsecured loan whose rates are fundamentally down, and you can pay back the complete loans for bad credit Early amount in full. Similar to this, you won’t just obvious your debt with ease, you can take advantage of quicker interest levels.

Minimizes Bad Affect Credit history

Your credit rating ‘s the solitary the very first thing you to determines their creditworthiness. Delaying your instalments will certainly reduce your credit rating significantly. Ergo, if you have racked upwards personal credit card debt, unlike not able to pay just minimal count each month, availing an unsecured loan may help.

Affordable Fees Selection

If you’re one another handmade cards and private money was types of personal debt, unsecured loans is apparently more affordable. Whenever you are playing cards do include an attraction-free months, otherwise make the most of after that it the attention recharged is pretty highest.

Just is the interest all the way down private fund (compared to the playing cards), however the EMIs are very reasonable and sensible. Given the selection anywhere between charge card money and private mortgage EMIs, the latter is frequently much easier on wallet.

Easy to Get that have Enough time Payment Conditions

Unlike credit cards that go through stringent approval processes, personal loans are relatively hassle-free to get. Certain lenders like Currency See offer personal loans of up to Rs. 5 lakh with minimal documentation requirements.

In addition to that, after accepted, the borrowed funds matter will be credited for your requirements inside twenty-four occasions. It is a great choice for those who urgently you desire finance. Repaying a mortgage is additionally convenient considering the prolonged payment options. Money Examine, such as, now offers cost words starting between 6 months so you can 5 years.

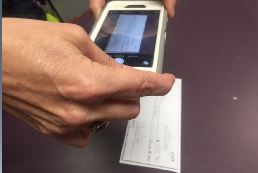

The good thing? You might use and you may avail the borrowed funds from your house because of the paperless application procedure.

To summarize

While personal loans are generally regularly get services otherwise services, one of the recommended spends of economic product is in order to make it easier to pay back their personal credit card debt. Besides would you be free from mastercard personal debt however your credit history also thanks a lot!

If you are looking for an affordable personal loan that you can avail from your home within a few hours, visit the Money View web site or download the application apply today. Have you paid your credit card debt using personal loans? What else have you used personal loans for? Let us know in the comments below.